The Main Principles Of Life Insurance Companies Near Me

Table of ContentsThe 5-Minute Rule for Whole Life Insurance LouisvilleThings about Life InsuranceEverything about Life InsuranceIndicators on Life Insurance Companies Near Me You Need To KnowThe Single Strategy To Use For American Income LifeA Biased View of Child Whole Life Insurance

The insured event lied on the plan application. Insurance coverage companies can postpone repayment for 6 to 12 months if the insured event dies within the initial two years of the plan.The default payment alternative of the majority of policies stays a swelling amount, states Richard Reich, president of Intramark Insurance policy Providers, Inc. Installments and Annuities Modern life insurance policy plans have seen a huge renovation in how payouts can be supplied to the plan's recipients, claims Bernstein.

These choices offer the plan owner the possibility to select a pre-determined, guaranteed income stream of in between 5 and 40 years. "For income-protection life insurance policy, the majority of life insurance coverage buyers favor the installation alternative to ensure the earnings will last for the necessary number of years," claims Bernstein (Life insurance company). Recipients ought to bear in mind that any type of passion earnings they obtain goes through taxes.

Life Insurance Louisville Ky Fundamentals Explained

Maintained Possession Account Some insurers offer beneficiaries of huge plans a checkbook rather of a round figure or normal installations. The insurer, serving as a bank or banks, maintains the payout in an account, permitting you to create checks against the equilibrium. Such an account would certainly not permit down payments however would pay rate of interest to the beneficiary.

(For associated insight, take a closer consider increased advantage cyclists.) Commonly, life insurance plans will only pay at the time of the insurance holder's fatality. Talk with your insurance agent concerning whether this option makes sense for you. Term life insurance Louisville. Take into consideration talking with an insurance policy agent and/or estate planning lawyer about which payment alternative might work best.

Recognizing how the process works, from getting life insurance policy to suing to obtaining a payment, can help you continue with your plans to acquire protection with confidence.

The 5-Minute Rule for Child Whole Life Insurance

Originally made to help cover funeral expenses as well as look after widows and orphans, life insurance is currently an adaptable and powerful economic item. Over half of Americans have some type of life insurance coverage, according to insurance research study company LIMRA (Life insurance Louisville KY).Life insurance coverage can be provided as either an individual or team policy.

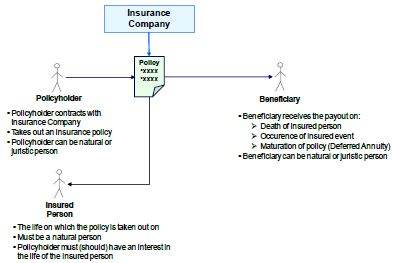

What is life insurance policy? Life insurance is a contract between you as well as an insurance coverage business.

The Best Guide To Whole Life Insurance Louisville

If you don't pass away throughout that time, nobody makes money. Term life is prominent since it offers large payments at a reduced expense than long-term life. It's additionally a short-lived option. It exists for the same reason short-term tattoos and hair dyes do occasionally a little while is long sufficient.

You have a mortgage that you don't want to saddle your partner with after your death. You can't manage the greater premiums of irreversible life insurance policy as well as still want coverage. There are some variants on regular term life insurance policies. Exchangeable plans allow you to convert them to long-term life policies at a greater price, permitting longer, extra versatile insurance coverage.

Rumored Buzz on Life Insurance Companies Near Me

Whole life is the most popular version of this kind of life insurance policy, however there are various other flavors, including universal life and variable life. Irreversible life insurance policies construct cash money worth as they age.

Money worth normally rises swiftly at the beginning of a plan's life, when you're younger and also less costly to guarantee. Whole life plans enhance cash value at a fixed price, while universal policies change with the market. It requires time to build the cash money value in these accounts, which you should consider when purchasing life insurance policy.

You can obtain from it, make withdrawals or simply utilize the passion settlements to cover the premium later on in life. You can also give up the policy, trading your survivor benefit for the value presently in the account, minus some costs. All of these options can develop complex tax concerns, so make certain you talk with a fee-based financial expert before touching your cash worth.

What Does Senior Whole Life Insurance Mean?

Whole life premiums are a whole lot greater than term life insurance premiums. If you contrast typical life insurance policy rates, index you can see the difference. $500,000 of whole life protection for a healthy 30-year-old lady expenses around $3,558 yearly, on average. That same degree of protection with a 20-year term life policy would set you back an average of concerning $193 each year.

Universal life policies allow you to make larger or smaller repayments, depending on your funds or exactly how the financial investment account does. Indexed global life, IUL, is a kind of global life insurance coverage that puts financial investments into index funds, created by the insurer, which attempt to track the supply market.